By Dean Kendall

•

October 8, 2019

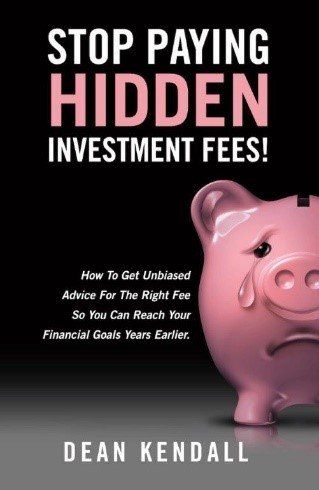

Here is a quote directly from the organization that develops, promotes and enforces professional standards in financial planning, The Financial Planning Standards Council: Financial planning is not regulated in most Canadian provinces. This means that anyone can call themselves a "financial planner". However, not everyone who refers to themselves as a planner is indeed qualified; many so-called financial planners are licensed to sell products but have no financial planning training or expertise. In the absence of government regulation, consumers must ensure their planner is indeed trained, certified, and held accountable in providing professional financial planning. Allowing anyone to hold themselves out as a financial planner leaves Canadians confused and at risk. Half of Canadians believe financial planners are regulated. They are not. The need for unbiased financial advice has never been more urgent. While many financial planners voluntarily seek out rigorous education and certifications, some people who call themselves financial planners don’t have the skills or qualifications to provide financial planning and are not accountable to any oversight body or subject to government regulations. This is a pretty scary reality, especially when you consider the importance of finances in one’s life and that money and financial issues are one of the single biggest sources of stress for most people. Yet, few consumers ever question what sort of education or experience their advisors possess, or the professional standards their advisors are held to. Most people just assume that their financial advisors have their best interests at heart and that it is generally NOT the case. Can anyone call themselves a surgeon, accountant or dentist? No. Why then, is an industry so critical to your survival so lightly regulated? Canada’s regulators must require a fiduciary standard. They currently do not. A fiduciary duty is defined as a legal duty to act solely in another party’s best interests. Fiduciaries have a duty to avoid conflicts of interest between themselves and their principals, and may not profit from their relationship with a principal without their express consent. The concept of a fiduciary duty has been in society for centuries, and is central to the English common law system, as well as modern securities regulation. Currently, financial advisors in Canada are held to a “suitability” standard that does not require them to act in the best interests of their clients, instead, they must simply ensure that any investment recommendations are suitable given a client’s risk tolerance and return objectives. The implementation of a fiduciary standard would have widespread implications for the financial industry, as advisors would be required to ensure that all recommendations were in the best interest of their clients, including the minimization of all fees and expenses, which is typically at odds with the advisor’s goal of maximizing revenue from a client account. This would involve a shift towards the client’s goals and objectives ahead of the advisors. Buyer Beware!! Generic Advice Too many of these so called “advisors” sell investment products without truly understanding your values, goals or objectives. They have no idea of the larger landscape of your situation. Without understanding the entire picture, how could they possibly give you proper advice? In these circumstances the advisor’s value promise is generally very product centered with a focus on sales tactics such as risk avoidance, supposedly superior past performance, rates of return, and hope. Product Focus We need to clarify what we mean by a financial product vs. a financial service because products are generally speaking “the root of all evil.” A financial “product” is a pre-packaged investment, insurance policy or other financial instrument. The reason products are suspect is that they generally are packed with hidden fees. They are sold at a given “price” or “rate” or “charge,” but there are many hidden fees not easily discovered without some real due diligence on your part. These products are often the perfect vehicle for hidden fees and they often hide conflicts of interest for the advisors who sell them. A financial “service,” on the other hand, might include drafting a will or estate plan or creating a financial plan. Generally these are billed on an hourly basis or are charged at a flat fee for a given outcome or deliverable. These can be easily comparison shopped and the fees are generally transparent to the investor. Help from a Friend Can Get You in Trouble Sadly, when people are scared or confused, they turn to their well-meaning friends, family and colleagues for advice, even though none of these people are licensed or qualified as investment advisors. Even if they have had success investing, your situation and needs may be very different. The World is Changing. Canada is Lagging. Canada is definitely lagging in regards to disclosure, transparency and high fees. The marketplace is changing. You do not have to settle for poor transparency and high hidden fees. You can become better informed, discover new opportunities and make much better choices. It’s up to you to consider these new possibilities and move forward. The fact that you are reading this article is an excellent first step. It is easy to learn how not to get ripped off. You just have to know where to look and what questions to ask. Advice matters In today’s world, managing personal finance is complicated and shouldn’t be done alone. Yet a study by the Financial Planning Standards Council found that 6 in 10 Canadians have never reached out to a professional for advice. There are many reasons for this, including misperceptions about who can use an advisor. Dean Kendall is a Financial Organizer in Calgary, handling all of the financial affairs for a select group of clients who value unbiased quality advice for one simple flat fee. His latest book is Stop Paying Hidden Investment Fees! Click here for more information https://ideal-life-experience.ca/deans-book In addition, Dean is a 3X Canadian National # 1 Amateur, a 5X Canadian National #1 Professional BMX rider, downhill mountain biker and an avid snowboarder. He is an expert at winning. Let him show you how to win the money game. You can reach Dean at dean@ideal-life-experience.ca or Phone 403-543 -7226 Copyright 2008 – 2019 by Dean Kendall. All rights reserved. 403 543 7226 dean@ideal-life-experience.ca